Join our clients in achieving the American Dream!

Become a U.S. Green Card Holder by investing in EB-5

MONEY NETWORK is providing good guidance or consulting for EB-5 immigrant investor visa program or employment-based fifth preference category.

Begin your journey to U.S. permanent residence with a $500k investment.

Benefits of an EB-5 Investment:

- The right to live, work, study or build a business anywhere in the United States

- Permanent residency for your spouse and dependents under 21

- Access to the finest universities, health care facilities, and social programs

- Opportunity to become a U.S.Citizen

- Visa-free travel to over 160 countries.

The EB-5 program enables non-US citizens to achieve an American PR (Permanent Residency) by investing $500,000 in an EB-5 compliant project. Via this investment, the alien investor, spouse and kids under 21 years, can get green card approval in under 24 months from investment. The investment must create 10 American Jobs and remain invested (At Risk) throughout the EB-5 process which could last upto 5 years.

HOW DOES EB-5 WORK

1. Invest $500,000

Choose an EB-5 project and invest $500,000 in a government approved regional center.

2. Receive Green Card

Receive your conditional green card in as little as 20-24 months, move to the U.S. with your eligible family members

3. Receive Permanent Residency & Repayment of Investment

After USCIS and Project requirements have been satisfied, the investor should anticipate Permanent U.S. Residency for the investor and their eligible family and ultimately the repayment of their $500,000 investment.

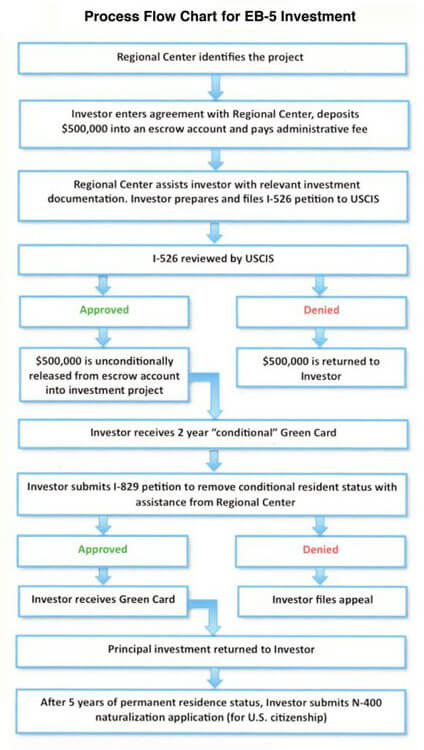

EB-5 investment process

The EB-5 investment process can be confusing and complicated and often involves interaction with multiple governmental agencies in both the United States and the investor’s home country. The paperwork and documentation needed to successfully submit an I-526 petition can be quite daunting. EB-5 investors must complete and submit petition paperwork, the accompanying business plan, various reports and all other requisite ancillary documentation. Smart petitioners understand that the process requires important input and preparation of materials by experienced industry professionals. Below is a quick overview of some professional resources that are vital to putting together a successful EB-5 petition.

EB-5 business plans must comply with the requirements of USCIS as set forth in 1998 in a precedent-setting case which has become known as Matter of Ho. In that case, a list of mandated elements that must be present in all EB-5 business plans was set forth. This list essentially clarifies what must be shown by the petitioner to establish that the proposed business and the business plan are credible.

The list of required elements includes the following:

- A budget and financial projections,

- Personnel experience,

- A description of the business,

- A marketing plan with target market analysis,

- The business structure,

- Staffing timetable for hiring,

- Required licenses and permits,

- Job descriptions, and

- A competitive analysis.

Many of these required elements are complicated and challenging and must be presented professionally and with extensive detail. The best way to ensure that the business plan is prepared in accordance with USCIS’s mandate is to engage the services of a professional EB-5 business plan writing company.

Essentially, the business plan should show how the proposed business plans to utilize the EB-5 investment to create jobs and to stimulate the economy. By using a professional business plan preparation firm, the EB-5 investor (or developer) can have confidence that the plan has the best possible chance of passing USCIS scrutiny. A good business plan company knows USCIS’s requirements inside and out and knows how to best show that the mandated requirements are likely to be fulfilled by the EB-5 petitioner.

The more detail included in a business plan submitted with the EB-5 petitions, the better the chances are for the determination of the business’ potential for success by the reviewing agency. The reviewing agency must be able to draw “reasonable inferences” about the business’ potential viability from a basis provided in the business plan. Along with the counsel of an experienced immigration attorney, professional business plan preparation is one of the most important outside resources for EB-5 petitions.

Economists

As noted, Matter of Ho requires that the EB-5 investor document the job creation and economic impact of the EB-5 investment within the business plan. Although this requirement can be shown in different ways, the best way to satisfy this vital requirement is through an economic study prepared by a professional economist. A professional economist speaks the economic language that USCIS examiners want to see regarding the economic impacts of the proposed project. Through statistics and charts, an experienced economist can make a convincing argument, backed by solid calculations and assumptions, that the EB-5 project will create the required 10 full-time jobs and that the anticipated economic impact justifies the approval of the I-526 petition.

A good resource to find a qualified economic consultant is the National Association for Business Economics (NABE). The NABE is the largest international association of applied economists, strategists, academics, and policy-makers committed to the application of economics. The association’s membership is divided into various subject-oriented subdivisions or roundtables, which makes it is easy to find an economist experienced in the type of business proposed by the EB-5 petition. Many business plan firms also offer this service through experienced economists that they utilize on a regular basis.

Conclusion

Successful EB-5 investors make use of professional resources. The additional expense of using such professional resources is more than offset by the improved success rate enjoyed by those who commit to presenting strong, professional business plans, petitions and ancillary documents to USCIS.

EB- 5 Visa Process

EB-5 is a United States visa program, created in 1990, that enables foreign investors to obtain a U.S.

visa by investing in a business that will benefit the U.S. economy and create jobs.

What is the EB 5 Program ?

The EB-5 visa, employment-based fifth preference categoryor EB-5 Immigrant Investor Visa Program, created in 1990 by the Immigration Act of 1990, provides a method for eligible Immigrant Investors to become lawful permanent residents — informally known as green cardholders — by investing at least $1,000,000 to finance a business in the United States that will employ at least 10 American workers. Most immigrant investors who use the EB-5 program invest in a targeted employment area (TEA)— a rural area or area with high unemployment — which lowers the investment threshold to $500,000.The EB-5 program is intended to encourage both foreign investments and economic growth. The EB-5 Immigrant Investor Visa Program is one of five employment-based (EB) preference programs in the United States.

Requirements

In order to obtain a permanent residency through the EB-5 visa program, foreign investors must meet the specific United State citizenship and Immigration (USCIS) requirements. Overall, the investor must meet the following requirements- capital investment amount requirement, job creation and make certain that the business receiving the investment qualifies for the EB-5 visa program. Once all requirements have been successfully met and approved by the USCIS, the EB-5 visa applicants as well as their spouse and children under 21 will obtain their permanent residency green card.

Pre-requisites

EB- 5 investment amount :

A capital investment of $500,000 or $1 million is required to be made by theEB-5 visa applicants into a U.S. commercial enterprise. The EB-5 investment can be taken in the form of cash, inventory, equipment, secured indebtedness, tangible property, or cash equivalents which is valuated based on U.S. dollar fair-market value.

If the investment is made in a commercial entity that is located in a targeted employment area (TEA), the minimum amount of capital required for the EB-5 visa program may have decreased from $1 million to $500,000. To qualify for TEA designation, the EB-5 project must either be in a rural area or in an area that has high unemployment.

A geographic location with an unemployment rate that is at least 150 percent of the national unemployment rate at the time of the EB-5 investment qualifies for a high unemployment area. Geographic regions that are outside of a city with a population of 20,000 or more are the rural areas. Rural areas can also be geographic regions that are outside of what the U.S. Office of Management and Budget has designated as metropolitan statistical areas

Eb-5 Job Creation

The USCIS requires the EB-5 investments to create 10 full-time jobs for U.S workers. After the investor has received their conditional permanent residency, within a period of two years these jobs must be created. In a few cases, the investor must be able to prove that their investment resulted in the creation of direct jobs for employees who work directly within the commercial entity that received the investment. If the investment was made in a regional centre, the EB-5 investor may only have to show that 10 full-time indirect or induced jobs were created. Indirect jobs are jobs created in businesses that supply goods or services to the EB-5 project. As a result of income being spent by EB-5 project employees, Induced jobs are jobs created within the greater community.

EB-5 Business Entities

An EB-5 visa applicant can invest in several types of business entities. Over-all, the EB-5 visa applicants can directly invest in a new commercial enterprise or in a regional centre. New commercial enterprises include corporations, limited or general partnerships, sole proprietorships, business trusts, or other privately or publicly owned business structures are lawful for-profit entities that can take one of many different business structures. All new commercial enterprises must have been established after November 29, 1990.

If the investment leads to a 40-percent increase in the number of employees or net worth, or if an older business is restructured to such a degree that a new commercial enterprise results, then an older commercial enterprises may qualify. Additionally, EB-5 visa applicants can also invest in EB-5 Regional Centers. Regional centers administer EB-5 projects. It may be more advantageous for an investor to invest in a regional center-run project because the investor will not have to independently set up the EB-5 projects.

What is a regional center?

An EB-5 Regional Center is an organization designated by United States Citizenship and Immigration Services (USCIS) that sponsors capital investment projects for investment by EB-5 investors. The regional center can take advantage of indirect job creation which is a major advantage, since regional centers help EB-5 investors and project developers to lessen the difficulty of meeting qualifying job creation requirements under the EB-5 program rules. Any private or public economic entity that is involved with the promotion of job creation, increased domestic capital as well as improved regional productivity and increased economic growth can be a regional center.

Regional centers are best for EB-5 applicants who are more concerned with obtaining residency status rather than directly managing an investment on their own.